The integration between e·silentpartner and Nelco/Yearli offers a user-friendly interface that simplifies the entire filing process. For all your 1099-NEC or 1099-MISC filings, you can manage all federal, state, and recipient requirements in one place. The platform allows you to:

- Import data from your e·silentpartner software

- View and manage filing statuses and forms

- Track deadlines and access forms with ease

This centralized approach makes year-end reporting more efficient and less stressful.

In addition to Yearli’s complete e-file services, Nelco offers 1099 paper forms and payment supplies that are guaranteed compatible with e·silentpartner.

Setting Up your account

The first step is to set up your Yearli account, by using this link.

Creating a file

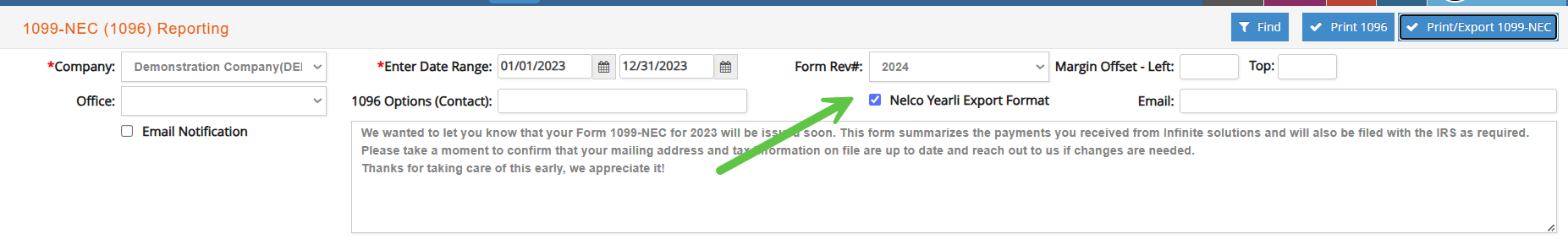

Under AP > REPORTS > 1099 NEC or MISC, a new checkbox will allow you to automatically download a csv file with your 1099 information.

Upload this csv file to your Yearli account, so Yearli can continue the process and electronically send your 1099 information to the IRS.