From the top navigation menu, select A/R then Reverse Payment.

Select the Client from the dropdown or click the blue Client label. Next enter the exact check number and tab or click out of the field.

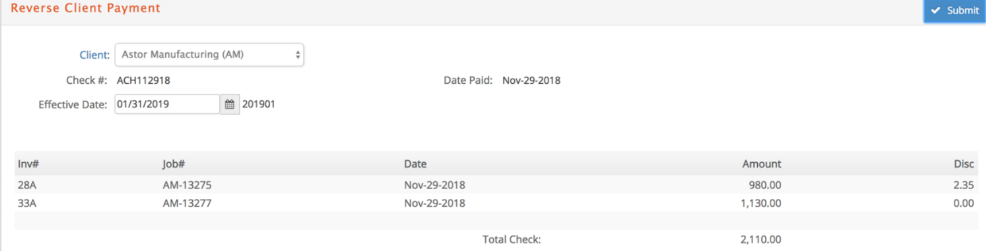

Upon tabbing out of the check number field the check will populate in the lower section of the window and displays payment information, including: invoice #, Job #, Date, Amount and any discount, if applicable as shown here:

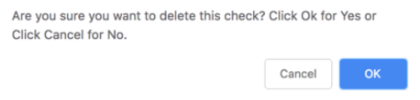

Enter an Effective Date and click Submit. You will be prompted to answer if you are sure you wish to delete this payment? Answer accordingly.

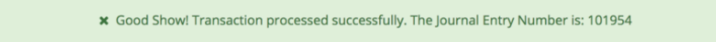

When processing is completed you will receive a message with the JE created reversing the payment.

During the update process, the following activities occur:

-

A Journal Entry is posted to the General Ledger which credits the cash account with the payment amount, debits the Accounts Receivable account(s) with the payment amount plus any payment discounts given, and credits the revenue adjustment accounts with the total of any payment discounts given.

-

Updates the client invoice within Accounts Receivable with the payment and discount reversed.

-

Marks the client invoice as OPEN to indicate the invoice is not paid in full.

-

A reversing duplicate of the original payment is created and credited for the fiscal period in which the reversal is executed. This reversing payment is assigned the original check# that is appended with a ‘D’ such as ACH112918D. Both the original and the reversing payment are marked as cancelled as of the date keyed in the ‘Effective Date’ field.