The Administration area of General Ledger is designed to group processes that occur infrequently.

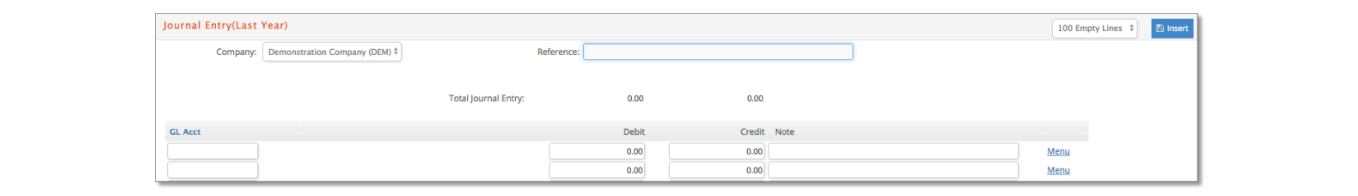

Last Year Journal Entry

Recognizing that sometimes adjusting entries must be made to the prior year after the year is closed, we have made available a journal entry posting process that updates your prior year. That is the purpose of the Last Year Journal Entry feature.

This journal entry process works exactly as a current year journal entry with two exceptions: a journal entry entered in this window cannot be reversed and when e·silentpartner creates the journal entry, it automatically sets the posting date entry date to be the last day of your prior fiscal year. This cannot be changed.

Entering a last year journal entry is the same as the journal entry process described in the main G/L section.

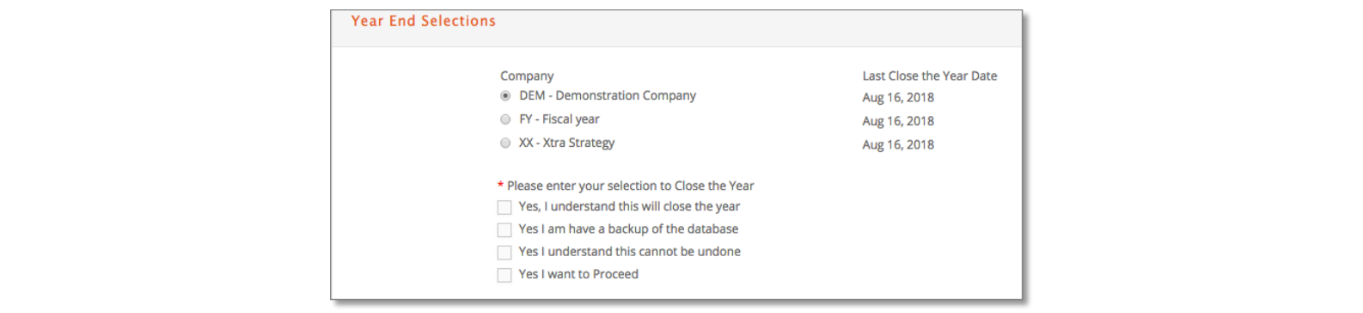

Close the Year

The fiscal calendar for the current financial year with your company must be closed within e·silentpartner by the first day of the third month of the next fiscal year. This is the purpose of the close the year procedure under G/L.

The Close the Year process resets all general ledger balances for the current year to last year and what is considered next year to periods one and two of the new current year. Subsidiary ledgers and the fiscal calendar for prior year, current year and next year are sets as well.

Due to the extensive preparation for closing the year and validation of financial data after you close the year, we developed an extensive document describing this process.

Close the Year documentation is available for hosted clients and non-hosted clients on the eForum customer support site. Please review this document in detail before you close the year to follow all the steps needed to successfully run this process.

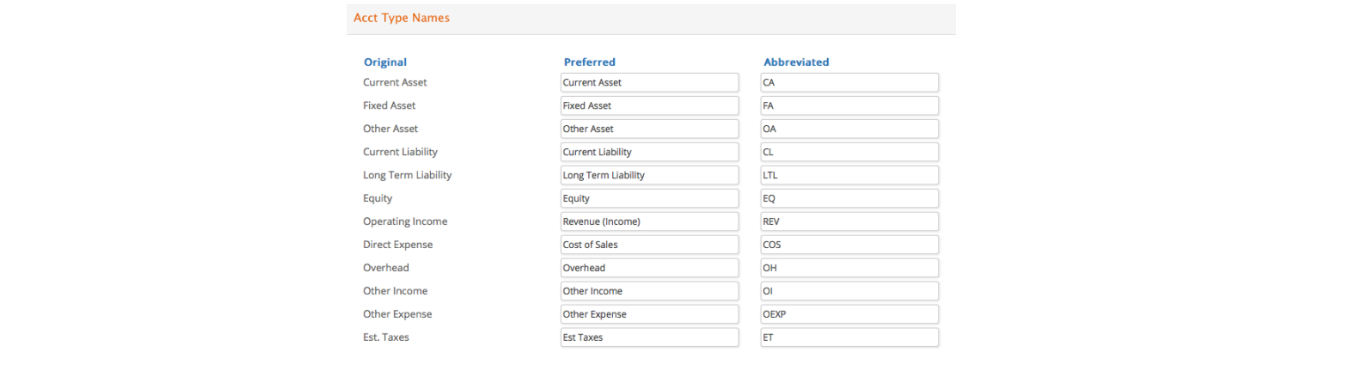

Account Type Name

When the e·silentpartner database is initially created, we populate it with default account types. These can be changed if desired. Account type name as sub-headings and totals in your Balance Sheet, company P&L and other financial reporting as well as in the GL Accounts window

Any changes you make to this window are saved as soon as you tab out of the modified field.

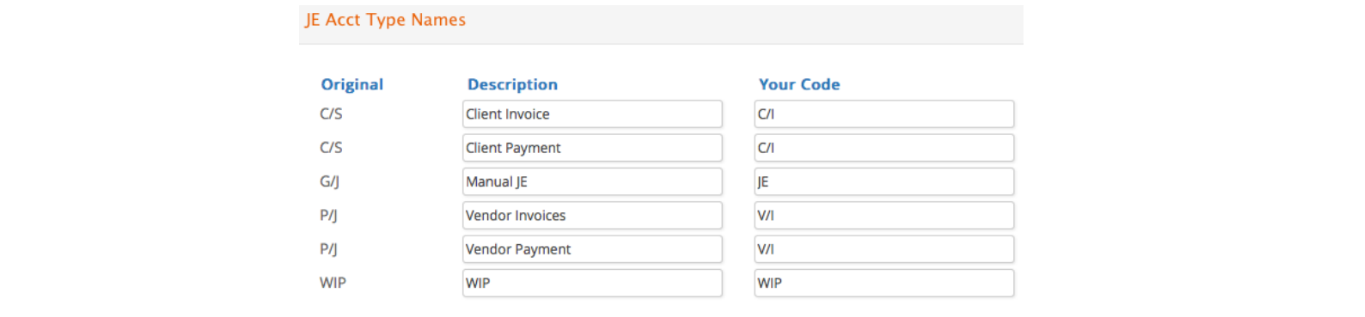

JE Account Type Name

In addition to the account type descriptors, you can also change the default journal entry references that are appended to each journal entry.

When a journal entry is created when a client invoice is posted, e·silentpartner will include a reference with the journal entry. This reference prints on the detailed general ledger and transaction journal.

Any changes you make to this window are saved as soon as you tab out of the modified field.

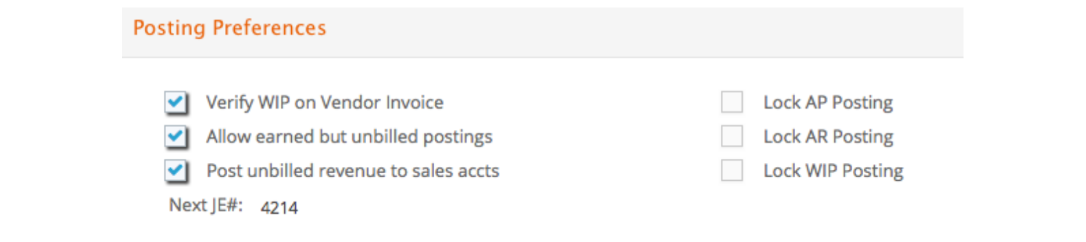

Posting Preferences

Invoked from G/L > Setup > Posting Preferences...this section is used to define some of your requirements in client billings and general posting techniques.

- Verify WIP on Vendor Invoice: Click this option if you want e·silentpartner to verify that the amount you enter to WIP is equally distributed to BILLABLE jobs.

- Allow earned but unbilled posting: Allows earned but unbilled postings.

- Post-Unbilled Revenue to Sales Account: This option permits revenues from unbilled charges to be recorded in a Sales Account instead of an Accrual Account.

- Next JE #: This allows you to indicate the number to be used for the first journal entry posted. This number is incremented by one every time a journal entry is generated.

- Lock AP Posting: When the Batch Posting process is invoked, e·silentpartner temporarily puts a 'hold' on adjusting any vendor invoices until the posting process is completed. This is to prevent someone from adjusting an invoice that is part of the current batch being posted. When the posting is completed, e·silentpartner automatically removes the ‘lock’.

- Lock AR Posting: When the Batch Posting process is invoked, e·silentpartner temporarily puts a 'hold' on adjusting any client invoices until the posting process is completed. This is to prevent someone from adjusting an invoice that is part of the current batch being posted. When the posting is completed, e·silentpartner automatically removes the ‘lock’.

- Lock WIP Posting: When the Batch Billing process is in progress e·silentpartner puts a temporary hold on the job records posted in WIP. This feature prevents any adjustments to such records. This hold is removed when the process is completed.

These features also serve a protective function. If a mechanical or electrical problem occurs during the posting session, the overall processing will cease. As a result, the 'lock' will not be removed. If this occurs, simply go to the Posting Preferences window and remove the 'lock' (un-check the box).

If you receive an error message, "SOMEONE ELSE IS POSTING INVOICES. YOU'LL HAVE TO WAIT UNTIL THAT PROCESSING IS FINISHED" and no one else is posting, you will know this has occurred. Go to GL > Admin > Posting Preferences > uncheck the box that is locked > Save Changes.

Revaluation

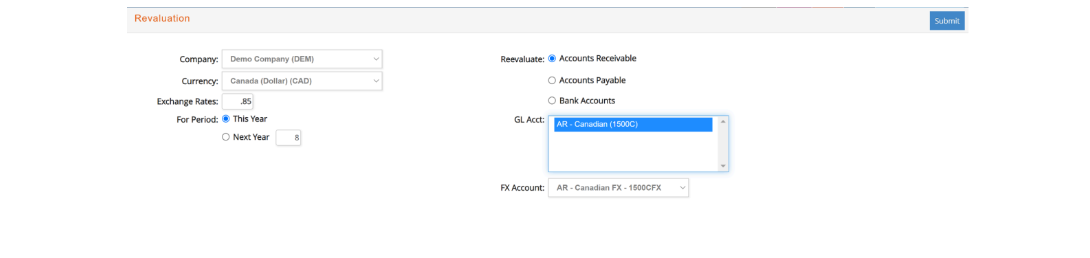

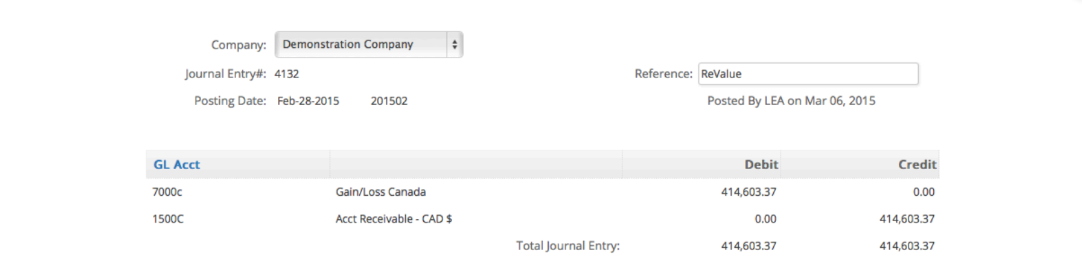

e·silentpartner supports multi-currency processing. Accordingly, sub-ledgers are maintained in the company currency and the source currency of the source transaction. Revaluation process provides the ability to apply a new exchange rate to the source transaction. The effect of the new exchange rate will create a journal entry impacting the foreign exchange and gain/loss accounts. Let’s follow an example.

Demonstration Company is a US-based company and maintains its financial records in USD. It deals extensively with Canada. Thus, it has both Accounts Receivable and Accounts Payable in Canadian dollars. We want to revalue the Canadian Accounts Receivable using the prevailing exchange rate at the end of the fiscal period.

The first step is to select the currency you want to revalue, the Exchange Rate to be used for the Revaluation process, and the specific fiscal period.

Select either Accounts Receivable, Accounts Payable or Banks Accounts. For each of these options, you can choose to select specific accounts or all accounts in one category, and specific FX account. By default, the system will present the FX account setup in the GL > Setup > Currencies > Exchange rate, but you will be presented with other options in the dropdown if you need to choose a different one. Once all your selection criteria is entered, click "Submit"

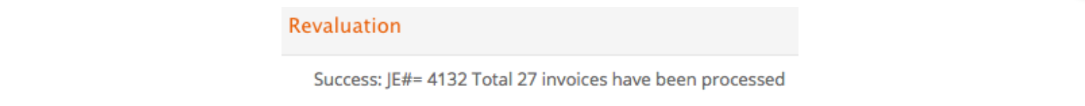

When the process is completed, e·silentpartner displays an audit message which contains the journal entry number.

Go to G/L Journal Entry to find the specific journal entry.

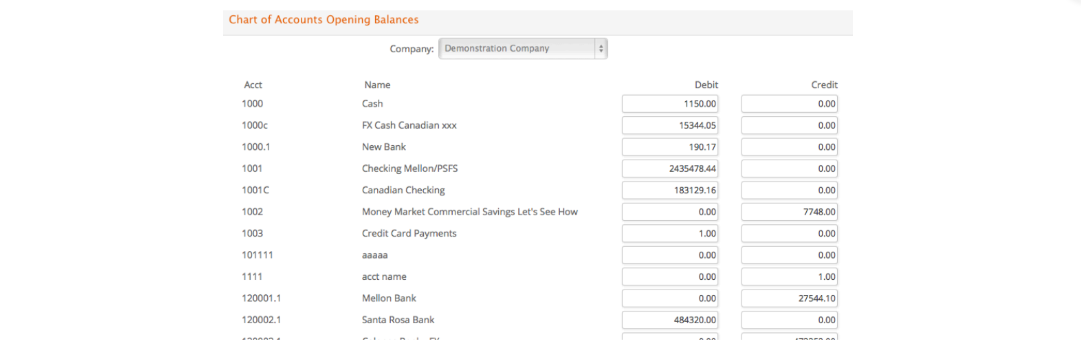

Opening Balances

This option is used when installing e·silentpartner in the middle of a financial year. This function impacts e·silentpartner's chart of accounts balances directly. It does not require you to key all the transactions that make up an account's balance.

To set up your financial accounts opening balances, select G/L > Setup > Opening Balances. e·silentpartner will display a window of all Balance Sheet Accounts in your general ledger.

Simply key in your opening balances and click "Save Changes"

Your entries will be saved as This Year Opening Balances.

Audit

If any unbalance occurs in Trial balance, please, run this option to recalculate.