This section contains Question and Answers to Frequently Asked Questions regarding the e·silentpartner Accounts Payable (A/P) module.

How do I clear adjusting Journal Entries from the A/P Bank Reconciliation?

How do I clear adjusting Journal Entries from the A/P Bank Reconciliation?

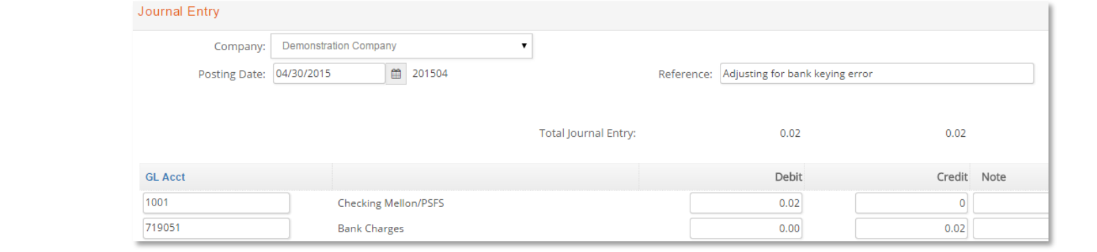

If you have entered an adjusting Journal Entry to correct a bank General Ledger balance, then you may need to clear these entries before you proceed with the Bank Reconciliation process.

Each uncancelled transaction in the bank reconciliation window affects the calculation for both the ending bank and computed account balances.

Ask yourself, "Will this transaction be processed by the bank?" If not, then it must be cleared before you proceed with the reconciliation. If yes, then it should be left in transit until it clears the bank.

If you need to clear an adjusting entry based upon a ‘no’ response from the question above, follow these steps:

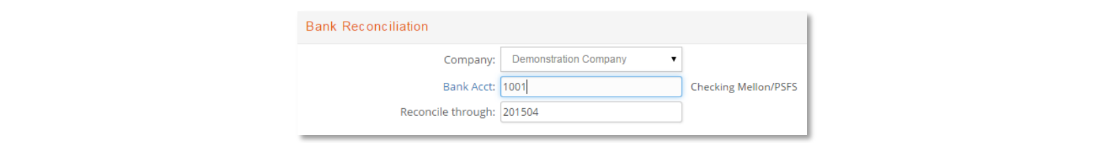

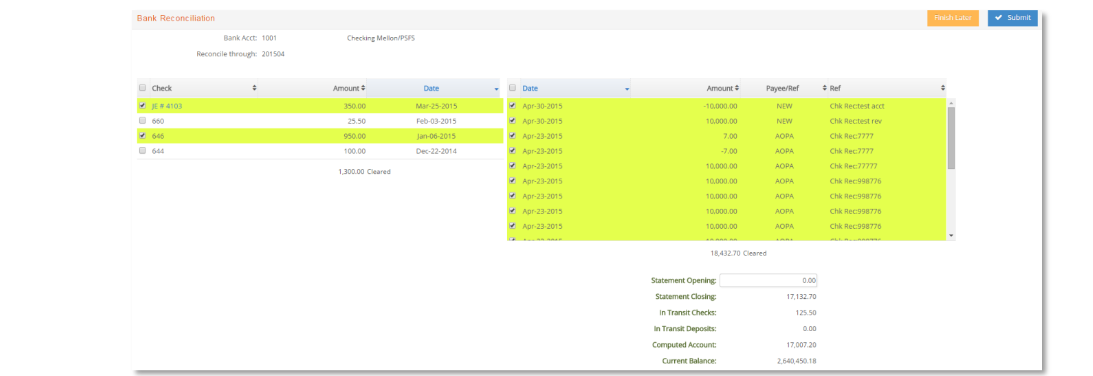

- Go to AP Reconciliation and open the window for the bank account and month for which the transaction was posted.

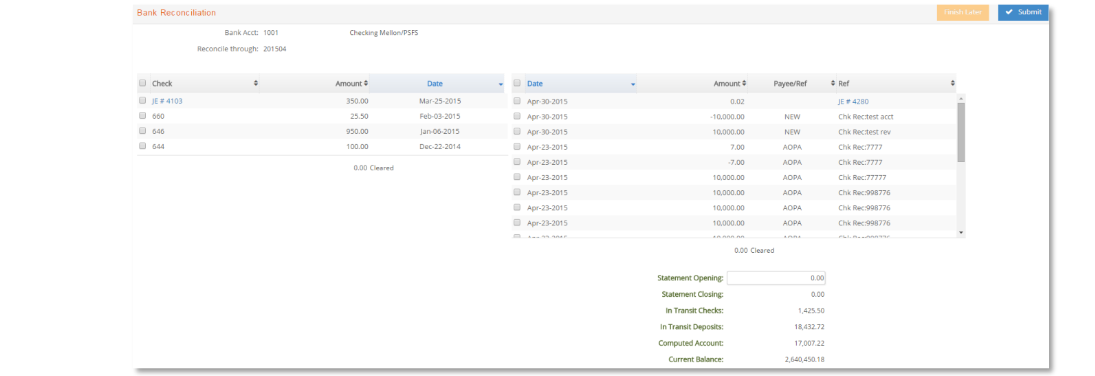

- If necessary, uncheck all transactions that are highlighted to be cleared so the cleared checks and deposits amounts are both zero. Note: Do not click the Finish Later button at this point since you don't want to lose your prior selections.

- Next check to clear only those adjusting journal entries that need to be removed.

- Leave the Statement Opening balance as 0.00 and click to the Submit button.

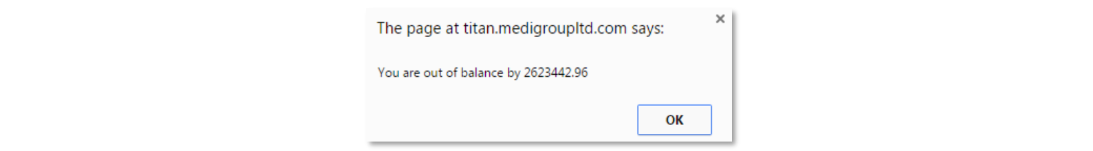

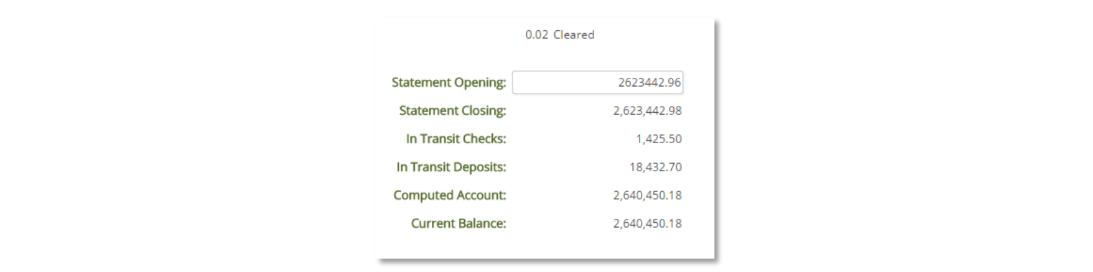

- eSP will display an error message with the out of balance amount. Write down this amount.

- Use the amount from step 5 above as the Statement Opening balance. This should make the Current and Computed Account balances match. If not, then enter the amount from step 5 above as a negative. If necessary, repeat step 5.

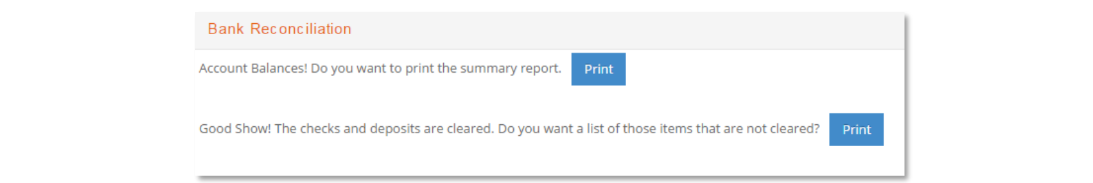

- Click Submit to proceed with the bank reconciliation. If necessary, you can skip printing the reports.

- Finally, you may now return to the Bank Reconciliation window and process the correct in transit transactions.

How to record credit card payments?

How to record credit card payments?

While e·silentpartner does not directly process credit card transactions, you can process and record the credit card transaction within the application.

This example provides an overview of how Vendor invoices that have been paid with a company credit card can be handled.

Setup:

- Go to GL > GL Accounts and add a GL bank account. Name it something like “Credit Card Payments”

GL Type: Current Asset (or Current Liability if preferred)

Select: Bank Account

Last Chk #: 999

This account will be used to mark vendor or media supplier invoices as paid when they are actually paid by credit card. - Enter purchase orders (optional) and media orders in the usual manner by assigning the orders to the actual vendors.

- Enter AP vendor and media supplier invoices in the normal manner by adding the invoices under the actual vendors.

- Review the example process as follows

a. An invoice is received in January and paid via company credit card.

Many agencies will wait until the credit card bill is received to enter the invoices. However, the vendor or media supplier invoices could be entered when the invoices are received and charged to a credit card.

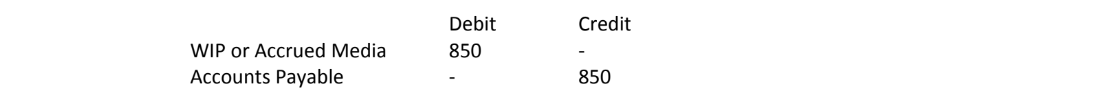

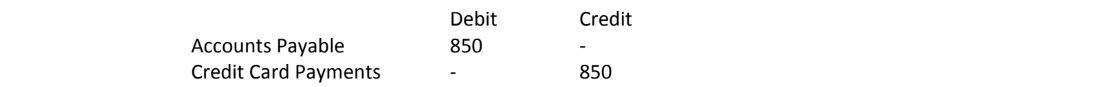

b. The invoice is entered from either the AP Vendor Invoice or Media Supplier Invoice window and posted to January. The resulting Journal Entry is:

c. A ‘dummy’ AP Computer Check or HW Check for the vendor invoice is created in January and paid using the “Credit Card Payments” bank account. The resulting Journal Entry is:

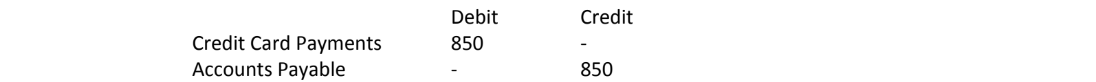

d. The credit card bill is received and entered in the AP Vendor Invoice window. The GL distribution for the charge is the Credit Card Payments account without a job distribution. The invoice is posted to January. The resulting Journal Entry is:

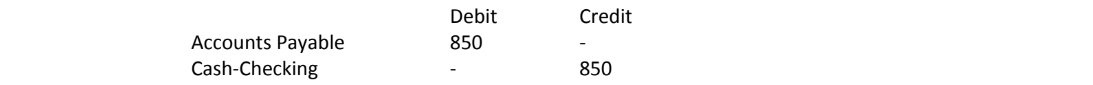

e. An actual AP Computer Check or HW Chk (Handwritten Check) is cut for the credit card bill in January. The resulting Journal Entry is:

Each credit card payment may be handled accordingly.