How to reconcile your checking accounts using your monthly bank statement.

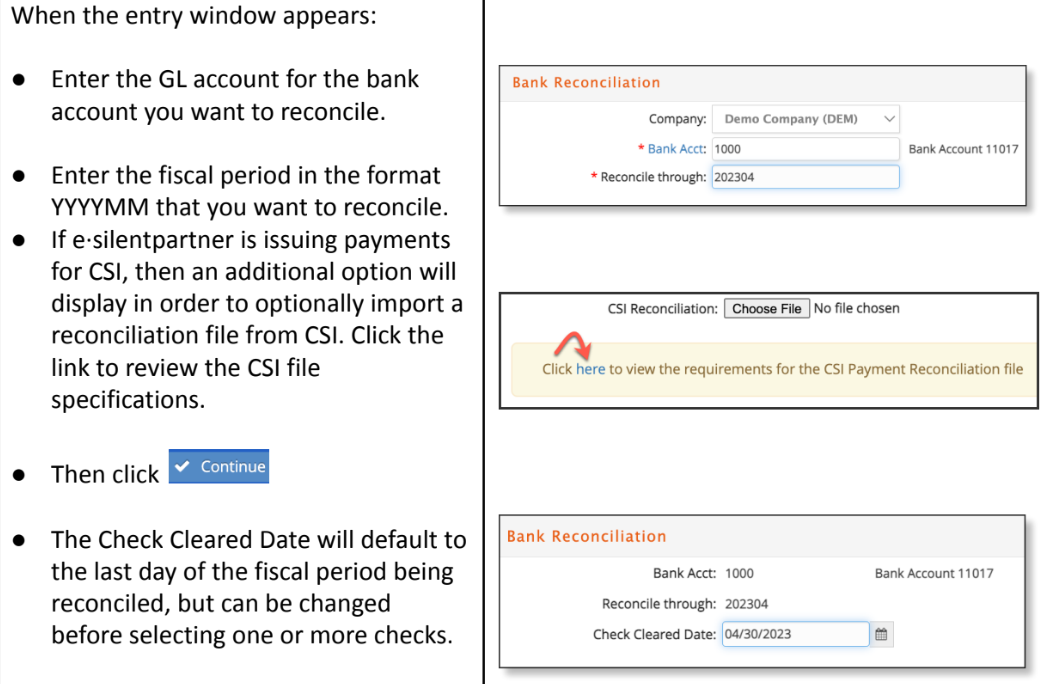

Select Reconciliation from the A/P menu.

e·silentpartner retrieves all reconciliation information on this account and displays it in the Uncanceled Checks and Deposits sections.

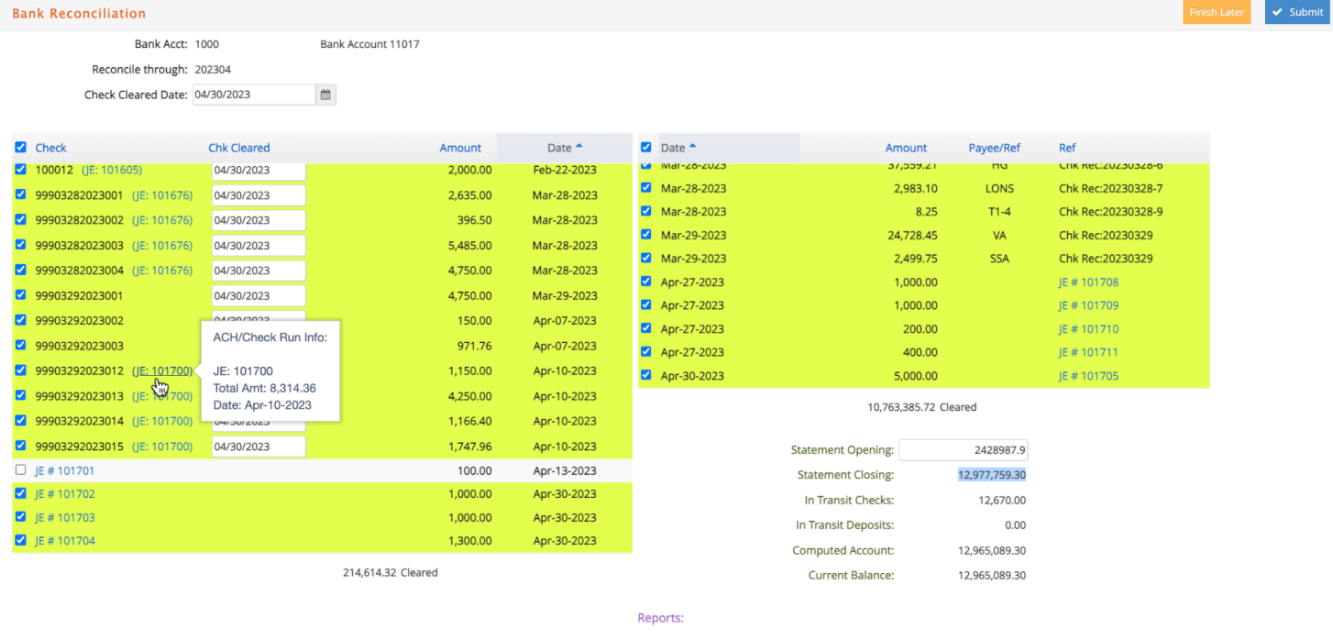

Click on each deposit and disbursement that is cleared in your statement.

-

Click anywhere on check or deposit lines that isn’t a link to select them for clearing with the bank reconciliation.

-

The cleared date selected in the header will automatically default for any selected checks, but can be changed. Additionally, manually entering the cleared date for individual checks will automatically select them for clearing as well.

-

For any computer check batches with more than one check, mouseover the JE# to view a popover with the total amount for any uncleared associated checks. Then click on the JE# to view a list of all the vendor checks included in the batch JE. These can help when reconciling batches paid as ACH eCheck.

-

Click on any manual JE#s to view the associated journal entry.

-

All selected checks and deposits will show highlighted in yellow and add into the total check or deposit ‘Cleared’ amounts.

-

Enter the Statement Opening Balance from the bank statement.

-

When Current Balance and Computer Account match, you are in balance to proceed

with the reconciliation. -

Don’t worry, if you need to stop reconciling because you need to post another charge to this fiscal period. Simply click

to . e·silentpartner saves all of your entries. When you return to the same reconciliation process, the entries that you marked as cleared will be highlighted. Then continue with the reconciliation.

to . e·silentpartner saves all of your entries. When you return to the same reconciliation process, the entries that you marked as cleared will be highlighted. Then continue with the reconciliation.

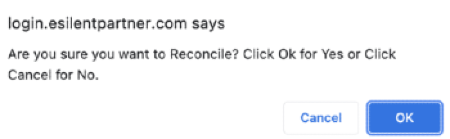

When you are in balance, click  and respond to the prompt.

and respond to the prompt.

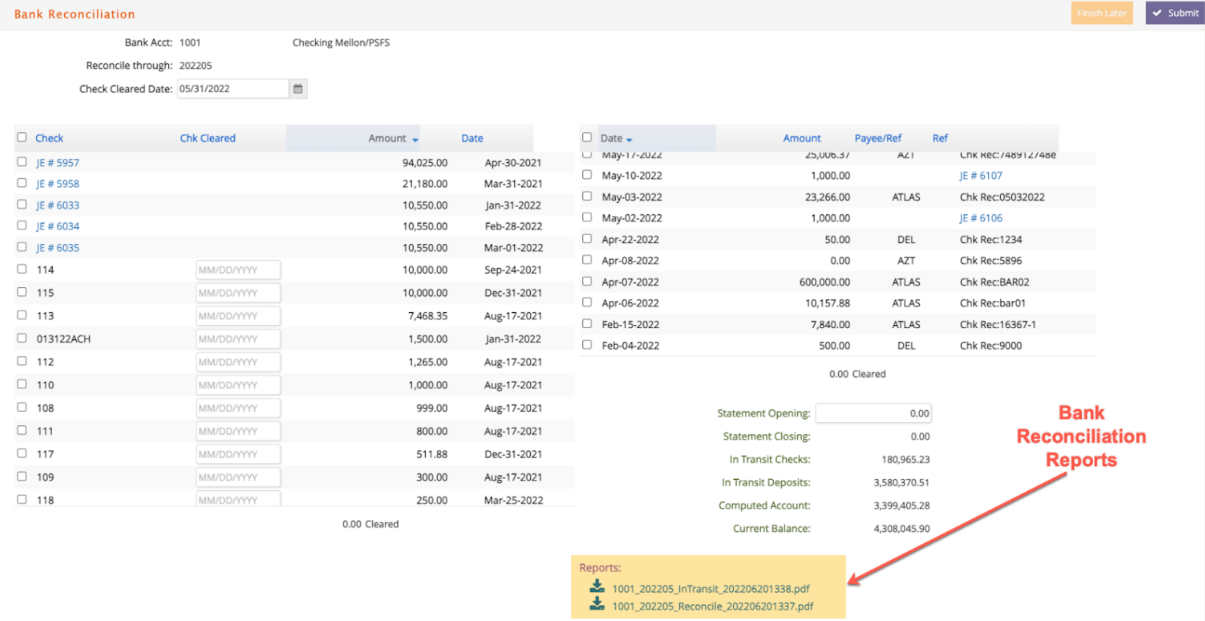

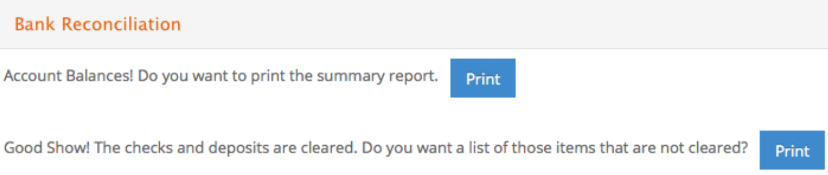

After your entries are updated, you have the opportunity to print the reconciliation report as well as the list of deposits and disbursements that are still outstanding at the end of this reconciliation period.

Make sure to print both reports so they will automatically save as PDFs to the bank reconciliation window for future reference. You may also download them as PDF formats.

Both of these reports are beneficial audit reporting tools.

Later if you want to download the reconciliation reports, then simply select the bank account and GL period for the reports needed. PDF file links will be visible at the bottom right of the window even if the bank reconciliation is subsequently reversed to create an audit trail.