Vendor Invoices, Add a Vendor Invoice, To Find a Vendor, Invoice, To Dupe a Vendor Invoice, To Delete a Vendor Invoice,To Change a Vendor Invoice, Add a Group Vendor Invoice

ON THIS PAGE

- Vendor Invoices

- Add a Vendor Invoice

- To Find a Vendor Invoice

- To Dupe a Vendor Invoice

- To Delete a Vendor Invoice

- To Change a Vendor Invoice

- Add a Group Vendor Invoice

Vendor Invoice

Vendor invoices are bills for goods and/or services contracted by you and for which you are now liable. The Vendor Invoice section integrates information from and disburses information to many areas within your e·silentpartner database. These include Purchase Orders, General Ledger, Jobs, Vendors/Employees, and Accounts Payable. Within the Vendor Invoice section, e·silentpartner will automatically:

- Save the initial entry of an employee or Vendor Invoice with a status of VOUCHR for later posting to General Ledger, Accounts Payable, and possibly Job Cost Accounting; or alternatively with a status of PEND if you wish to keep making changes before deciding then invoice is ready to be posted.

- If applicable, add the Vendor Invoice breakdown to one or more jobs that are indicated at the point of entry. These Job charges will be added with a status of VOUCHR to reflect that you have received a bill for materials/services pertaining to a specific client job(s) but the invoice has not yet been posted to General Ledger.

- Update the purchase order associated with the Vendor Invoice to indicate that you have been billed for the details ordered on the purchase order.

As shown on the following graphic, entry of a Vendor Invoice can consist of up to three areas: the Vendor Invoice header, the Invoice General Ledger (GL) details, and the Job charges distribution section.

The Invoice Header and Invoice GL Details are required in order to enter a Vendor Invoice. Section three, Job Charges/Details, is optional except when you are distributing Work in Process (WIP) or direct expenses to the General Ledger.

The following is an example of an invoice that was entered. Let’s review each section.

The following is an explanation of each field:

Vendor: The code and name of the vendor or employee who issued this invoice.

-

AP Acct: Accounts Payable account that will be used when posting this invoice. At the moment of entry, this field is pre-populated with the default accounts payable account defined for this vendor/employee (under Setup > Vendor –or Employee).

-

PO#: This is the purchase order number associated with this invoice. If entered, the purchase order must refer to an existing purchase order within the system that is issued to this vendor and has an OPEN status. This entry is optional.

-

Invoice: An invoice number assigned by the vendor or you. Please note, duplicate invoice numbers for the same vendor/employee are not allowed. A maximum of 25 alphanumeric characters are allowed.

-

Bill #: This is a unique number automatically assigned by e·silentpartner to each invoice entered into the database.

-

Invoice Date: The date of the invoice. It may or not be the same date used when posting the invoice.

-

Due Date: The date payment is due on this invoice. e·silentpartner calculates the initial due date based on the payment terms you established for this vendor (i.e. Net 30 days adds the Net days to the invoice date to calculate the due date). You may override the due date at the point of entry –or later- if necessary.

-

Paid Date: If there are payments for the invoice, this field will be populated with the date of the most recent check that paid this invoice.

-

-

Posted: The fiscal period in which the invoice is posted.

-

Status: Assigned by e·silentpartner. The status is either:

OPEN – Invoice is posted and has an outstanding balance.

PAID – Invoice is posted and has no outstanding balance –it has either been fully paid or deleted.

VOUCHR – Invoice has not been posted.

PEND – Either for an Expense Report, which needs to be submitted for approval, or an AP Vendor Invoice, that needs to be corrected before it can be saved as VOUCHR status before posting, or needs to stay 'editable' before posting- Expense Report invoices can only be submitted for approval by the user

that added the expense report. These invoice always assign the Invoice#

as the Bill#. - For PEND status AP invoices which require correction, e·silentpartner

makes note of the reason in the description field of the Vendor Invoice.

Generally, this means money was incorrectly distributed in the General

Ledger and/or Job Charges sections.

REQA, REQD – If the vendor invoice is linked to an Expense Report submitted by an employee and it is still going through the approval process. REQA means that the expense report has been requested for approval and REQD means that the expense report has been returned to the employee to be modified. Emails are automatically sent for the approval request and return notification.

- Expense Report invoices can only be submitted for approval by the user

-

Paying: The currency in which this invoice was entered. This is determined by the currency

of the Accounts Payable account selected. -

Description: A 500-character field you can use to enter comments about the invoice.

-

Balance: The amount owed on this invoice (invoice amount - amount paid).

-

Amount: The amount entered for this invoice.

-

Tax Amt: Gives you the option to separate sales tax from invoice total.

-

JE: Once posted, click the link showing the JE# and posting date to review the journal entry.

Note: If you enter a tax amount and if a purchase tax account is set up in the GL > Admin > Company window, e·silentpartner will automatically subtract the tax amount from the invoice amount and show the purchase tax account in the General Ledger details section with the amount of the entered tax.

The Invoice GL Details section contains the details for the invoice to the General Ledger that will be used at the time of posting.

The following describes the use of accounts and the controls applied to the distribution to General Ledger.

- GL Acct: The General Ledger account that a portion or the entire invoice amount will be

posted to. - Description: The name of the General Ledger account.

- Amount: The amount that will be posted to the specified General Ledger account.

- Notepad: A text field to enter comments about a particular line of the General Ledger distribution line. If this note is entered before the invoice is posted, it will be included in the detail note of the journal entry.

When distributing an invoice amount to General Ledger, there are a few rules:

-

The General Ledger account must be active.

-

The company of the General Ledger account must belong to the same company of the Accounts Payable account.

-

The total of the amounts entered in the General Ledger section must equal the invoice amount. More than one account can be entered when distributing to General Ledger.

-

There are additional controls to prevent the client and company income statements from getting out of balance. Specifically,

- GL distribution for WIP must also be distributed to Billable Jobs and Items. If one of the General Ledger accounts is a WIP account, the amount specified for WIP must also be distributed to Billable Items on Billable Jobs in the Job Charges section.

- GL distribution for Cost of Sales or Direct Expense type accounts must also be distributed to a NON-BILLABLE job or a NOBILL item (cannot be distributed to

an INTERNAL job). - GL distributions for Overhead Accounts do not have to be distributed to Jobs, but if they are then they must be distributed to INTERNAL Jobs. You cannot

distribute Overhead amounts to NON-BILLABLE or BILLABLE Jobs. - To prevent unbalancing of the P&L to the Company Management Income,

sales / Operating Income type accounts can’t be used in the GL distribution

field.

-

Additionally, in order to avoid any out of balance in the Accrued Media subledger, there are controls that prevent the default Accrued Media account to be entered in this distribution for non-media vendor invoices.

-

The Job Charge Details contain the disbursement details for the invoice to company and/or client jobs.

-

Job: The job number that a portion of or the entire invoice amount will be charged.

-

Item: The item that should be billed with the total cost-plus markup. Mouseover an item code to view the associated name.

-

PO Cost: If a purchase order number is entered with the invoice, this field will reflect the remaining cost of each purchase order line that has not been invoiced in total.

-

Qty: The total quantity that should be charged to the item.

-

Cost: The portion of the invoice amount that should be charged to this item. This is your cost for the item.

-

Billing: The total amount that the client should be billed for this item. The initial billing amount is calculated by e·silentpartner using the billing rules set up for the job (i.e. bill at client rates or rate 1, 2 or 3), but it can be changed at the moment of entry if needed.

-

Notepad: A text area field to enter comments about a particular line of the GL

distribution line. -

‘Billing’ effect of the charge line: To the right of the charge line notepad, there will be a B, NB or I.

The meaning of each is:- B - Billable Item on a Billable Job.

- NB - Either a Billable item in a non-billable job or a non-billable item on a billable job.

- I - Internal Job.

-

Clip: Click to upload invoice copies or receipts for any associated job charges. Available after an invoice is initially inserted.

Add a Vendor Invoice

To add a new Vendor, click the orange plus (+) –it will turn green to indicate action- next to Vendor Invoices > Single on the A/P menu.

You will be presented with an empty vendor invoice window.

You also have the option of creating a Group Vendor Invoice to include more than one purchase order.

This is explained below in more detail.

Enter the vendor or employee (resource) in the vendor field. Note this field has auto-complete capability.

Accordingly, enter the code or any portion of the resource name.

A list of matches will display.

From this list select the vendor.

The AP Account for the selected vendor will default from the vendor record setup. If you wish to enter a vendor invoice for a different AP Account you can either overwrite the AP Account code with the new one or select the account from the pop-up window. To select from the pop-up, remove the default account and click the blue 'AP Acct’ link. Only accounts associated with the selected company that are set up with the GL Acct Type as ‘AP Acct’ may be used.

Enter an invoice number and invoice date. The due date will automatically populate from the settings on the vendor record.

By default, the invoice status will be set as VOUCHR, but you can decide to have it as PEND if you wish to keep on editing the invoice after creation.

If a PO was entered for the charge, be sure to enter the PO# so the PO can be updated with the invoiced amount. The PO# can be either typed in the PO field or picked from the pop-up window available when clicking on the blue ‘PO#’ link.

Enter an invoice amount – total invoice amount, taxes included- and tax amount, if applicable.

GL accounts will default from the vendor/employee record setup – modify if appropriate and enter the GL distributions.

Distribute to Jobs & Items in the bottom section if the invoice includes job related charges.

When you are finished, click the Insert button.

Some important considerations...

- Notice the Invoice General Ledger Details Section. If you had added General Ledger accounts to the vendor record, e·silentpartner retrieves those accounts when you enter the invoice amount and adds them to this section, with the invoice amount automatically allocated to the first account number.

- You can change any of the accounts or amounts by clicking on the account line and then editing the entry.

- Also if you need to add or change a GL account, this section ALSO has universal search capability. Simply type any portion of the GL account or the account name.

- If you enter a Purchase Order Number, notice the Job Charges Section. If the purchase order number is correct, e·silentpartner retrieves the detail lines (job numbers, items, and PO line cost) and automatically adds them to the Job Charges section. The dollar amounts are zero until you fill them in.

- If you enter an amount that does not match the PO detail line, you will be

queried to mark the line as DONE. If you will not receive any further

invoices for that PO line item, click OK. Otherwise click Cancel.

There are only a few rules for Job Charge distribution:

-

The job entered cannot have a status of FILED and must be assigned to the same company as the company of the Accounts Payable account entered.

-

The item entered must be active and must be assigned to the same company as the company of the entered Accounts Payable account.

-

The sum of the Billable Item Costs on Billable Jobs must equal the total entered against the WIP account.

-

You do not need to enter overhead amounts to internal jobs unless you want to track, in detail, specific expenditures (training, company functions, etc.)

-

You must enter costs against Non-Billable Items and/or Non-Billable Jobs if you are distributing monies to direct expense (or cost of sales accounts) because these allocations will flow into the management income statements, such as Client, Team, etc. When distributing a non-billable charge, the direct expense account needs to match the net account set up at the item level.

Note: The item must be set up with the billing currency of the job and an effective date prior to the invoice date. -

e·silentpartner will verify that the amount you are distributing to charges equals the amount you are distributing to GL accounts according to the rules explained before. If these two amounts do not equal, you will be presented with a message in the Vendor Invoice window indicating the problem and the invoice will have a status of PEND(ing). This invoice will not be updated to VOUCHR status until you balance these amounts.

-

Lastly, for Job Charges, e·silentpartner will automatically calculate the DEFAULT billing amount based on the job type, item, and markup rate you established when you entered the item record. You can override this if you do not want to accept the default.

To speed up the AP Invoice entry process, you can also use the ‘Dupe’ option and duplicate an existing AP vendor invoice record by clicking the blue ‘Dupe’ button.

This will duplicate most fields –that can be adjusted if needed- and create new blank fields necessary for unique data entries, including Invoice # or date.

To Find a Vendor Invoice

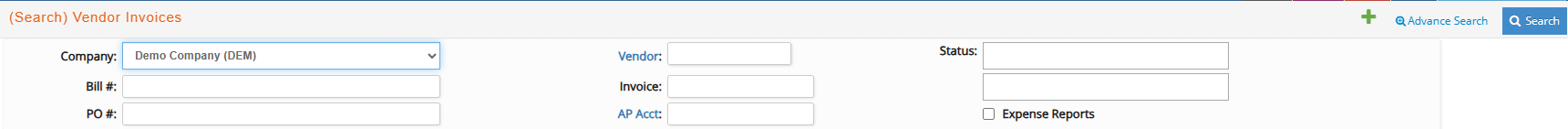

There are two types of Vendor Invoice search capabilities within e·silentpartner: Basic and Advance.

Click A/P on the menu bar to view the basic search option.

In this ‘Basic’ search feature you have several additional options to locate Vendor Invoices. Let’s review them.

Search for invoices for a specific Vendor by typing 3 or more characters of the vendor name to view an auto-complete list of matching vendors.

You can also click on the blue Vendor link to see the complete list of vendors in a pop-up window.

Further refine your vendor search in the pop-up window by typing in the ‘Search in records’ box. The displayed list will be redrawn to match your entry.

Then click on the vendor code to automatically close the pop-up window and populate the vendor field with your selection.

Select to print for a specific Bill#, Invoice, PO#, AP Acct or Payment Status (Approve, Hold or Review).

You can also search those vendor (or employee) invoices that are linked to

Expenses, by selecting the 'Expense Reports' checkbox.

Lastly, you can select more than one (vendor invoice) Status. Click in the Status field to be presented with the available options to choose including VOUCHR, OPEN, PAID, PEND, REQA, REQD or REQS.

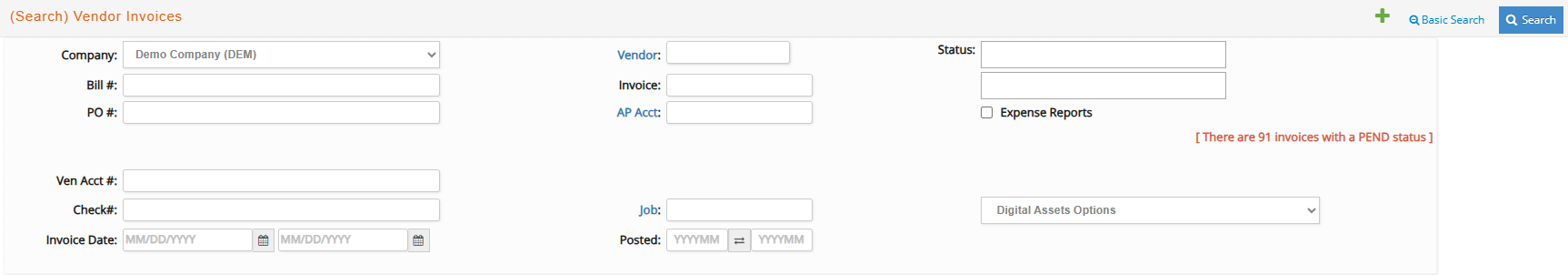

As per the Advance Search option, when clicking the window will be expanded to

provide additional fields you can use to further refine your search equirements.

- Vendor Acct #: Account number assigned to you by the vendor.

- Check #: Check or wire transfer number used to pay the vendor invoices or invoices

- Invoice Date: Range of invoice dates

- Job: Vendor invoices with charges distributed to a specific job

- Posted: Range of posting periods used to post the invoices.

- Digital Assets Options: Different options if your search criteria is based on the vendor invoice having or not digital assets attached to the vendor invoice or Job charges level.

After you’ve entered your search criteria –either under the options for Basic or Advance Search, click "Search" . A list with results matching your search criteria will display. Please note that the entire list can be re-sorted (ascending or descending) by simply clicking on any column heading.

Once reviewing an invoice, several actions may be performed including:

- If no payments have been applied to an invoice that is not associated with a done status PO, then you may modify the due date, invoice description, pay code or approval status dropdown and click Save Changes.

- Unpaid invoices (with a status of VOUCHR, PEND, OPEN, REQA, REQD, REQS) can now have uploaded a copy of the physical receipt by clicking on the paperclip icon on the top right corner.

- For any job charges, mouseover the item code to view the item name or click the clip button to upload an invoice/receipt copy.

- Click Dupe to copy, modify and insert similar invoice for the same vendor with an updated invoice #.

- When your invoice is displayed, click the on

the sidebar button to view the list of invoices from your last search.

the sidebar button to view the list of invoices from your last search.

Once this sidebar button is clicked, the search results list should slide left to open. This allows you to click to view any of the invoices from your search list.

To Dupe a Vendor Invoice

Invoices that occur again can be copied by duping and inserting them with any updated pertinent details. Simply find the the invoice to copy and then click  the button to copy it.

the button to copy it.

Once the new invoice window displays with the copied details, then the following changes may be made before inserting the new invoice:

- Enter the updated header information for the new invoice, such as invoice#, invoice

date, due date, amounts and invoice description. - Enter any needed GL distribution or job charge related changes.

- Any jobs from the original invoice with a Filed status are indicated in red since new charges may not be entered for them.

To Delete a Vendor Invoice

You can delete a Vendor Invoice if the invoice as long as there are no payments against it. After you find your invoice, click  the button to delete the invoice.

the button to delete the invoice.

An invoice that has not been posted can have any of the following status: PEND, REQA, REQD, REQS or VOUCHR.

If you click OK to the prompt, an invoice with any of these status’ will be removed from the database after inserting an audit trail note behind-the-scenes.

If you click Cancel, the invoice will stay in the database.

If the Vendor Invoice is posted and has no payment records against it, it can be deleted but it won’t be totally removed from the database: the system will create a negative reversing entry during the deletion process.

When starting the deletion of a posted invoice, you will be prompted to enter

a posting date for this transaction: this will have an impact on your AP subledger.

Upon clicking Process, you will receive the following alert.

A negative Vendor Invoice offsetting the original will be created. Note that the new invoice number is appended with a D, both invoices are marked as PAID and the amount of the new invoice is an offsetting negative, removing this invoice from your subledger.

If you wish to delete an invoice that has already payments, you will need first to void these payments. We will review the steps in the ‘Voiding a Check’ section of this manual.

To Change a Vendor Invoice

What you can change on an invoice depends on its status and whether it is associated with a done status PO.

Add a Group Vendor Invoice

There are times a vendor sends an invoice that covers several purchase orders. e·silentpartner provides a single-entry window to accommodate this requirement.

To create a Group Vendor invoice go to A/P > Vendor Invoices > Group+.

In the following window you will need to fill out the corresponding information for the required fields:

- Company

- Vendor

- Invoice number

- Invoice date

Optionally you can also enter a Client, Thru date and Notes.

After entering the information, the system will display all the open PO lines corresponding to those filters:

Select the PO lines you want to include in this group invoice. When selecting, the system will automatically update the Qty, Cost, and Billing amounts from the PO. If you wish to modify the amounts you will be prompted to decide if you want to mark the line as DONE if you will not receive any further invoices for it, or leave it OPEN.

The amount field will be updated the the cost of each PO selected. If you enter the cost directly into the field, the checkmark will not activate automatically and the amount will not be included in the invoice amount. Make sure you check the box of all PO lines you want to include.

When you are done including all the PO lines, click ‘Insert’ on the top right corner.

The system will then ask you to confirm the total amount for which the invoice will be created:

Click OK to create the invoice or Cancel to make any changes.

When the group invoice entry is saved, e·silentpartner will insert individual invoices for each purchase order. For example, here we entered invoice number 52369 and it was entered against three purchase orders, 51629, 51632, and 51633. e·silentpartner will create three invoices, taking the portion of the group invoice entry that was applied against each order. The invoice number on the respective invoices will be 52369:51629, 52369:51632, and 52369:51633.

You can click the link on each one to open the vendor invoice. All invoices will be inserted as VOUCHR status.